Payment institutions and fintech companies acknowledged a significant change in the mobile transaction segment. Giving digital organizations the edge they need to combine the mobile airtime transactions to the payment services.

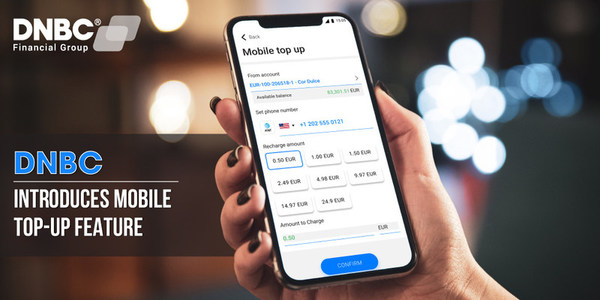

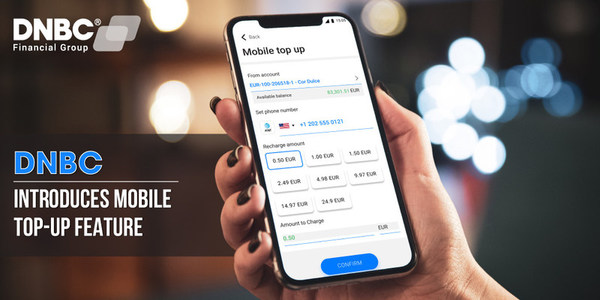

VANCOUVER, BC, Nov. 20, 2021 /PRNewswire/ — DNBC Financial Group introduces the launch of Mobile Top-up feature to the e-banking channel.

The post-lockdown still shows a change in habits that a lot of people keep using applications of technology with business case models, especially in terms of digital platforms, online transactions, and automated recharges. Many first-time users consider digital payments for their frequent transactions which bring up many opportunities for digital payment organizations to bring up advanced solutions and flexible services for users around the world.

Along with the digital development of e-banking services, DNBC officially launches the new feature of Mobile Top-up to offer a convenient solution for global users who have strong preference for digital payment services. Mobile Top-up is the newest digital project in terms of improving customers’ e-banking experiences. DNBC understands that it will take more time if the recharging process of mobile is manually processed by users. Therefore, synchronizing the digital method of prepaid mobile phones with the digital banking system will leverage user experience as well as add more value to DNBC services. Users can simply use the utility of DNBC Mobile Top-up via the e-banking channels to easily make prepaid top-up anytime.

The process is very simple, fast, and convenient. It requires users to own an online account from a global network operator or an e-banking service. Using a mobile number, browsing the telecommunication operator, choosing the recharged amount, and proceeding with payment. The entire process to complete a prepaid mobile recharge only takes around two minutes. Offering readily available lists of many global telecommunication operators to support international clients making mobile data top-up that are the same as services provided by network operators in their home countries.

DNBC Financial Group is the financial company that provides e-banking services such as processing payments, international transfers, online digital accounts, and multiple currency exchanges. The company began its journey in 2017 and supports individuals as well as organizations in business financial transactions across many countries over the world.

"DNBC has been planning to fortify business commitments and further hasten the growth of networks in which people can manage their finances, perform international remittance, shop everything with our payment system. Everything now is just in your hands, international payment now is just simple at your fingertips," Jimmy Lee, the Founder & CEO said.

DNBC has intentions to apply innovative technologies to consolidating services that improve the existing banking infrastructure. Always putting the customer base into offers to complete digital aspects of proposition for retail business, SME, and large business over global hubs. The crucial commitments are focused on creating more products and better digital solutions for users. DNBC enhances efficiency and convenience of transactions at all times. Connecting the consumer’s transactions with technology and improving customer experience with the latest features of digital payment services. DNBCnet Apps and DNBC e-banking systems have been constantly updated to satisfy even the most complex digital payment needs.

Related Links :

https://www.dnbcf.com