|

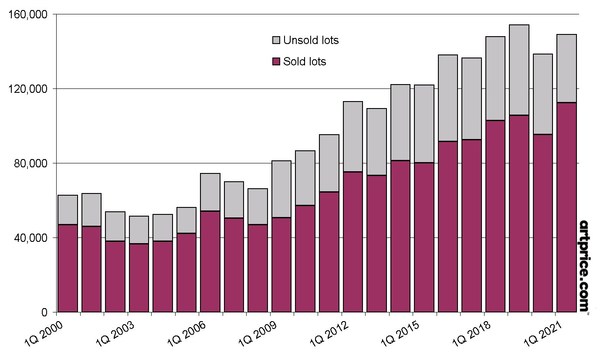

PARIS, April 20, 2021 /PRNewswire/ — With $1.6 billion hammered around the world in fine art auctions during the 1st quarter of 2021, the art market may look like it has already returned to a "normal" rhythm. True, the Q1 total is exactly the average Q1 total over the ten Q1 periods preceding the health crisis (2010 – 2019). But this impression, based on auction turnover alone, hides a very different situation from that which prevailed two years ago.

Q1 fine art auction turnover since 2000

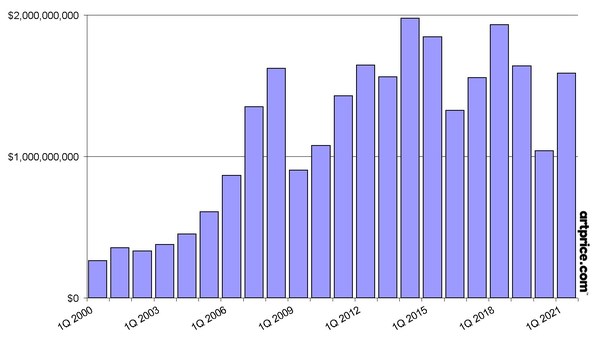

Fine art lots sold and unsold in Q1 auctions since 2000

thierry Ehrmann, President and Founder of Artmarket.com and its Artprice department, acknowledges that "it is still a little early to disentangle the effects of each of the powerful factors currently shaking the art market: Covid, Brexit, NFTs, etc. But their consequences are already visible".

Artprice is therefore redoubling its efforts to ensure continuous monitoring of the market’s most sensitive indicators and keep a close eye on its overall health. Artprice wishes to share the conclusions of its econometrics department in order to contribute to the market’s transparency.

1. A record number of transactions

Despite the logistical complications linked to the health crisis, fine art auction transactions have never been as numerous as in Q1 2021. In total, 112,200 lots were sold around the world, i.e. 6% more than in Q1 2019 (105,600 lots sold). The digital transition undertaken by the major auction houses has enabled the emergence of an online market that is particularly suited to the middle market.

2. A declining unsold rate

An key indicator of the balance between supply and demand in the market, the unsold rate varied only very slightly over the period 2010-2019, fluctuating between 31% and 34%. In other words, the art market has become accustomed to seeing a third of the lots offered for auction fail to reach their reserve prices. But in Q1 2021, only one in four sales (25%) failed: demand is therefore increasing a little faster than supply!

3. A gradual geographic rebalancing

Q1 turnover figures are usually dominated by London, which hosts the first prestige sales of the year. In 2021 the agenda had to be postponed by several weeks but nevertheless went ahead. However, the dominance of the UK capital appears weakened: London accounted for 37% of global sales revenue in Q1 2021 versus 48% in Q1 2019. New York, which managed to generate 27% of the global turnover in the first three months of the year, appears to be the main beneficiary.

4. The NFT revolution

The sale of Beeple’s NFT Everydays marked the start of a possible revolution on the art market. The work was purchased for $69 million in a Christie’s online auction using the Ether cryptocurrency. Indeed, this new market appears to have become even more ‘intangible’ since Sotheby’s generated $16.8 million by selling "The Fungible Collection", a digital work offered online in unlimited quantities and created by the anonymous and mysterious Pak.

5. Red-chips dethrone blue-chips

Since the end of 2020, art auctions around the world have hammered some surprising results for extremely recent works. Journalist Scott Reyburn (in The Art Newspaper) cites, as an example, Christie’s "20th Century: Hong Kong to New York" sale on 2 December 2020 and says he was surprised to see Dana Schutz’s canvas Elevator (2017) fetch $6.5 million and Andy Warhol’s "classic" Campbell’s Soup Can (1962) sell for just $6.1 million (especially as the latter reached $7.4 million in 2014). Reyburn concludes that the arrival of new collectors, in search of the latest novelties ("red-chips") is overtaking the desire to possess "blue-chip" artworks.

www.theartnewspaper.com/analysis/the-rush-for-red-chip-art

Images:

Copyright 1987-2021 thierry Ehrmann www.artprice.com – www.artmarket.com

- Don’t hesitate to contact our Econometrics Department for your requirements regarding statistics and personalized studies: [email protected]

- Try our services (free demo): https://www.artprice.com/demo

- Subscribe to our services: https://www.artprice.com/subscription

About Artmarket:

Artmarket.com is listed on Eurolist by Euronext Paris, SRD long only and Euroclear: 7478 – Bloomberg: PRC – Reuters: ARTF.

Discover Artmarket and its Artprice department on video: www.artprice.com/video

Artmarket and its Artprice department was founded in 1997 by its CEO, thierry Ehrmann. Artmarket and its Artprice department is controlled by Groupe Serveur, created in 1987.

See certified biography in Who’s who ©:

imgpublic.artprice.com/img/wp/sites/11/2019/10/biographie_oct2019_WhosWho_thierryEhrmann.pdf

Artmarket is a global player in the Art Market with, among other structures, its Artprice department, world leader in the accumulation, management and exploitation of historical and current art market information in databanks containing over 30 million indices and auction results, covering more than 770,000 artists.

Artprice Images® allows unlimited access to the largest Art Market image bank in the world: no less than 180 million digital images of photographs or engraved reproductions of artworks from 1700 to the present day, commented by our art historians.

Artmarket with its Artprice department accumulates data on a permanent basis from 6300 Auction Houses and produces key Art Market information for the main press and media agencies (7,200 publications). Its 4.5 million ‘members log in’ users have access to ads posted by other members, a network that today represents the leading Global Standardized Marketplace® to buy and sell artworks at a fixed or bid price (auctions regulated by paragraphs 2 and 3 of Article L 321.3 of France’s Commercial Code).

Artmarket with its Artprice department, has been awarded the State label "Innovative Company" by the Public Investment Bank (BPI) (for the second time in November 2018 for a new period of 3 years) which is supporting the company in its project to consolidate its position as a global player in the market art.

Artprice by Artmarket’s 2020 Global Art Market Report published in March 2021:

https://www.artprice.com/artprice-reports/the-art-market-in-2020

Index of press releases posted by Artmarket with its Artprice department:

serveur.serveur.com/press_release/pressreleaseen.htm

Follow all the Art Market news in real time with Artmarket and its Artprice department on Facebook and Twitter:

www.facebook.com/artpricedotcom/ (over 5 million followers)

Discover the alchemy and universe of Artmarket and its artprice department https://www.artprice.com/video headquartered at the famous Organe Contemporary Art Museum "The Abode of Chaos" (dixit The New York Times): https://issuu.com/demeureduchaos/docs/demeureduchaos-abodeofchaos-opus-ix-1999-2013

L’Obs – The Museum of the Future: https://youtu.be/29LXBPJrs-o

www.facebook.com/la.demeure.du.chaos.theabodeofchaos999

(4.5 million followers)

Contact Artmarket.com and its Artprice department – Contact: Thierry Ehrmann, [email protected]

Photo – https://mma.prnasia.com/media2/1491811/artmarket_artprice_1_fine_art_turnover_q1_since_2000_infographic.jpg?p=medium600

Photo – https://mma.prnasia.com/media2/1491812/artmarket_artprice_2_fine_art_lots_q1_since_2000_infographic.jpg?p=medium600

Logo – https://mma.prnasia.com/media2/1009603/Art_Market_logo.jpg?p=medium600