HO CHI MINH CITY, Vietnam, Nov. 17, 2021 /PRNewswire/ — On November 17th, 2021, PayConfirm, a transaction authentication solution by Airome, was introduced to Vietnam as a part of KMS Solutions’ Modern Banking (MOBA) platform. Offering a host of next-gen features, PayConfirm helps banks reduce SMS costs, strengthen fraud prevention, and enhance customer experience.

Each year, the 4 Vietnam’s state-owned banks spend 11,300 billion VND on SMSing. This prohibitive cost is why many forward-looking financial institutions are replacing SMS with more innovative methods. Typically, each OTP code sent via SMS costs about 500 VND, which, if multiplied by 50-80 million transactions to be authenticated monthly, can accumulate to dozens of billions.

"SMS becomes too expensive due to the rising rates and the growing volume of digital transactions. It is also no longer reliable since criminals are coming up with sophisticated schemes to exploit loopholes and customers’ inattention," said Mr. Le Huu Tan Tai, Vice President at KMS Solutions.

To help banks with an authentication process that is cost effective, secured, and convenient, KMS Solutions has partnered with Airome, a Singapore-based provider of cybersecurity technologies for banks, to embed PayConfirm into its Modern Banking (MOBA) platform. MOBA is KMS Solutions’ package of solutions that empower banks to digitize their business.

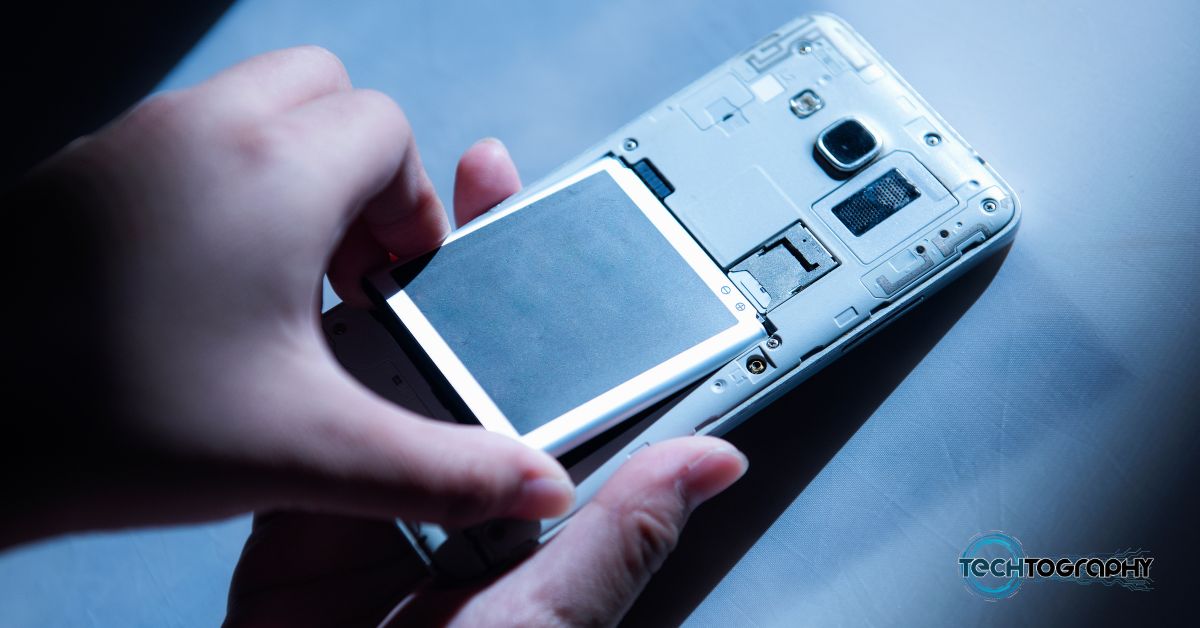

As a mobile transaction authentication signature (mTAS) solution, PayConfirm allows users to authenticate transactions without the fraud-prone SMSs or the inconvenient tokens. This means banks can do away with network carriers and their costly SMS.

Besides being able to work as a standalone application, PayConfirm can be integrated into banking products thanks to pre-built APIs. Moreover, its interface can be customized to suit banks’ brand.

When compared to SMS or tokens, PayConfirm is superior in terms of convenience and security.

PayConfirm is more convenient because users only need to tap "confirm" in the bank’s app to authorize transactions, instead of time-consuming tasks such as inputting passwords, scanning face and fingerprint, retrieving OTP, and signing digital signatures.

Regarding security, behind PayConfirm there are asymmetric cryptographic algorithms and client-server architecture with only 2 components: the bank’s server and the user’s phone device, which preempts all external intruders. PayConfirm can help banks put an end to SIM swap, social engineering, and OTP hijacking.

PayConfirm also allows customers to authenticate transactions in offline mode — without the internet — by scanning the auto-generated QR Code.

"Through PayConfirm, Airome hopes to help banks in the local market provide a convenient and secured authentication process, while optimizing SMS costs," said Mr. Denis Kalemberg, Co-Founder and CEO at Airome.

Since its inception, KMS Solutions has been working with leading software companies across the globe to bring the most innovative technologies to BFSI businesses. The partnership with Airome and the introduction of PayConfirm into MOBA further demonstrated its commitment to Vietnam’s digital banking.

On the other hand, Airome develops client-server software to authorize banking operations with world-class standards of security for preventing unauthorized transactions caused by man-in-the-middle, phishing, or social engineering attacks.

Related Links :

https://kms-solutions.asia/