The addition of USDT, USDC, DAI, WBTC, WETH, BNB, and BUSD provides more flexibility for users

|

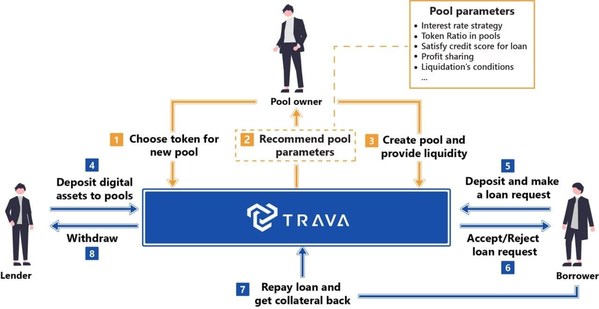

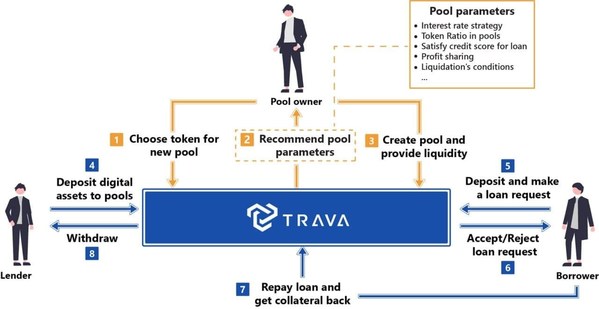

SINGAPORE, Sept. 16, 2021 /PRNewswire/ — Building on the novel lending protocol utilising multiple blockchains, Trava.Finance (https://trava.finance/), a project belonging to Datalink Foundation Pte.Ltd, is preparing to expand user options to strengthen its decentralised finance (DeFi) offering.

The Trava Lending Pool – a software product derived from Aave adding other unique functions – will support the use of USDT, USDC, DAI, WBTC, WETH, BNB, and BUSD as assets for users to draw from and allow for financial flexibility when creating their pools. Support for more tokens are in the works, and users can look forward to more in the future as the new lending pool develops further.

Making a Difference

Trava is also pushing out the W1 Liquidity Mining Program as an incentive to celebrate the monumental occasion. Any transactions that involve deposits or borrowing will see users be rewarded from a pool of 5.250.000 $TRAVA between September 16 to September 23 at 3 PM UTC.

Trava prides itself on serving users first, with the speed of transactions, gas fees, and robustness brought by the Binance Smart Chain network being instrumental, with cross-chain lending an imminent possibility across other networks, such as Avalanche, Polygon and Fantom in the near future.

Aside from the bespoke lending pools with parameters set by users themselves, Trava also provides users with a credit score, helping to reduce lending risks and allow those with higher credit scores to obtain a high Loan-to-Value ratio. Furthermore, the likes of non-fungible tokens (NFTs), stock tokens, and other digital assets are being looked at as possible collaterals.

Trava can already identify wallet addresses of users utilising different chains, which makes consolidation seamless when collateral is required for loans. More statistical functions and data analysis features are in the works, which will enhance the whole ecosystem for both users and the platform.

"DeFi has great potential, especially as blockchain technology continues to improve. Trava helps to achieve that potential. Through Trava, we can observe user needs and create unique functions to support them better," CEO & Co-Founder of Trava.Finance, Dr Minh Nguyen explained.

About TRAVA.FINANCE:

Trava.Finance (or Trava) is the world’s first decentralised marketplace for cross-chain lending and offers a flexible mechanism in which users can create and manage their lending pools to start a lending business.

Deployed on the Binance Smart Chain, Trava allows for lending with BSC tokens at initial stages, with cross-chain lending with various tokens on Ethereum and other blockchain networks enabled after. Established in 2018 with an initial 20+ members, the team has gathered outstanding specialists and individuals in blockchain, security, finance, risk management, and law to aid its growth. You can find out more about the team on https://trava.finance/.

Media Contact:

Ms Quinn Pham

Marketing Lead

Phone: +8457844722

Email: [email protected]

Related Links :

https://trava.finance