|

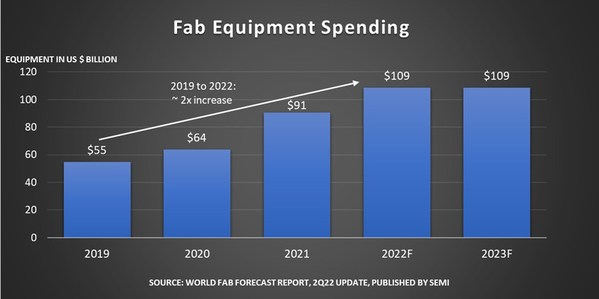

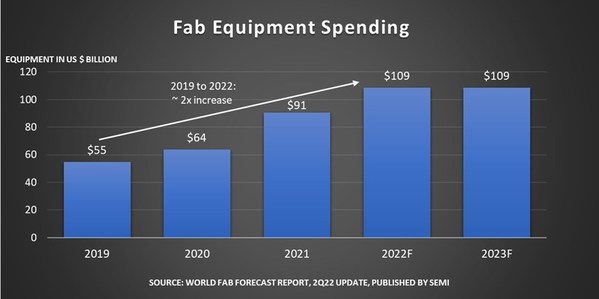

MILPITAS, Calif., June 13, 2022 /PRNewswire/ — Global fab equipment spending for front-end facilities is expected to increase 20% year-over-year (YOY) to an all-time high of US$109 billion in 2022, marking a third consecutive year of growth following a 42% surge in 2021, SEMI announced today in its latest quarterly World Fab Forecast report. Fab equipment investment in 2023 is expected to remain strong.

"The global semiconductor equipment industry remains on track to cross the $100 billion threshold for the first time as shown in our latest update of the World Fab Forecast," said Ajit Manocha, president and CEO of SEMI. "This historic milestone puts an exclamation point on the current run of unprecedented industry growth."

Taiwan is expected to lead fab equipment spending in 2022, increasing investments 52% YoY to US$34 billion, followed by Korea at US$25.5 billion, a 7% rise, and mainland China at US$17 billion, a 14% drop from its peak last year. Europe/Mideast is forecast to log record high spending of US$9.3 billion this year and, while comparatively smaller than outlays in other regions, its investments would represent a staggering growth of 176% YoY. Taiwan, Korea and Southeast Asia are also expected to register record-high investments in 2023.

In the Americas, the report shows fab equipment spending reaching US$9.3 billion in 2023, a 13% YoY rise following a 19% YoY increase in 2022, with the region retaining its fourth-place ranking both years in worldwide fab equipment spending.

The SEMI World Fab Forecast report shows the global industry increasing capacity 8% this year after a 7% rise in 2021. Capacity growth is expected to continue in 2023, rising 6%. The fab equipment industry last saw a YoY growth rate of 8% in 2010, when it topped 16 million wafers per month (200mm equivalents) – nearly half of the 29 million wafers per month (200mm equivalents) projected for 2023.

Over 85% of equipment spending in 2022 will stem from capacity increases at 158 fabs and production lines, a proportion expected to edge down to 83% next year as 129 known fabs and lines add capacity.

As expected, the foundry sector, with a share of about 53%, will account for the bulk of equipment spending in 2022 and 2023, followed by memory at 33% in 2022 and 34% in 2023. The two sectors also account for the largest capacity increases.

The latest update of the SEMI World Fab Forecast report, published in June, lists more than 1,400 facilities and lines globally, including 133 future facilities and lines with various probabilities that are expected to start volume production.

SEMI® connects more than 2,500 member companies and 1.3 million professionals worldwide to advance the technology and business of electronics design and manufacturing. SEMI members are responsible for the innovations in materials, design, equipment, software, devices, and services that enable smarter, faster, more powerful, and more affordable electronic products. Electronic System Design Alliance (ESD Alliance), FlexTech, the Fab Owners Alliance (FOA), the MEMS & Sensors Industry Group (MSIG) and SOI Consortium are SEMI Strategic Technology Communities. Visit www.semi.org to learn more, contact one of our worldwide offices, and connect with SEMI on LinkedIn and Twitter.

Association Contact

Michael Hall/SEMI

Phone: 1.408.943.7988

Email: [email protected]