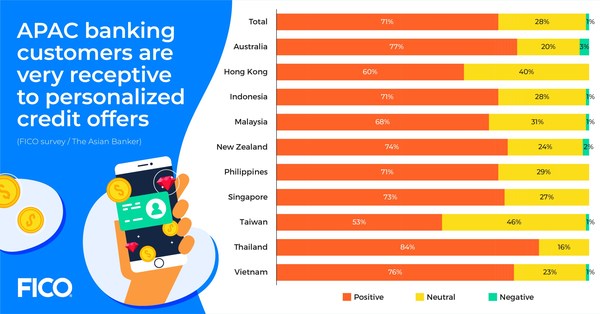

18 percent are very willing to offer more financial information for better interest rates or lower fees

|

HONG KONG, June 17, 2021 /PRNewswire/ —

Highlights:

- 65 percent of Hong Kong consumers not satisfied with generic credit offers from their bank

- 60 percent of Hong Kongers had a positive reaction to offers that took into consideration their circumstances

- 18 percent of Hong Kongers are very willing to offer more financial information for better interest rates or lower fees

A recent survey by global analytics software firm FICO has revealed that 65 percent of Hong Kong consumers are not satisfied with generic credit offers from their bank. The poll demonstrates growing ambivalence to generic financing solutions, with respondents across the region having expressed indifference to standard offers.

More information: https://www.fico.com/en/latest-thinking/market-research/advancing-new-experiences-digital-banking

There was broad discontent from consumers in Asia Pacific with the experience of taking up new products. 34 percent said they were not offered any attractive incentives (better rates, gifts), 31 percent said the bank failed to offer them a superior product to the one they applied for while 28 percent said the bank failed to offer any additional products to their liking.

By contrast when banks get personalized offers right there is an overwhelmingly positive reaction. 60 percent of Hong Kong consumers had a positive reaction to offers that took into consideration their circumstances.

"Capturing greater customer share of wallet will require re-imagining the entire digital lending process, particularly within the context of personalization," said Aashish Sharma, FICO senior director of decision management solutions in Asia Pacific. "Surveyed respondents remain unimpressed with banks that appear not to know them or be able to anticipate what they might need. Social media companies have worked out how to put ads in front of viewers that are targeted and which as a result see great engagement and uptake. Banks need to learn to do the same so that their customers are more open to additional products and services."

Consumers ready for pricing innovation

Banks can deepen their relationships with customers and build loyalty by offering better interest rates or lower fees in return for more financial information. Many banks in Hong Kong do not have a comprehensive pricing strategy that aligns with the organization’s overall business strategy, yet customers are extremely willing for banks to make them offers that consider their total customer relationship.

The survey showed that one in five Hong Kongers are very willing to offer more financial information for preferential pricing, while nearly three in five (56%) are somewhat willing to do so.

"Consumers are used to innovative pricing strategies from airlines, ride sharing services and insurance companies, yet banks are lagging behind," said Sharma. "Clearly there are opportunities for banks to move past single-product pricing and engage in improved cross-selling and increased product penetration. Banks may have gotten away with this so far due to the high inconvenience cost for customers of moving to a competitor, but with increased competition and the regulatory trend of open banking, we see this changing quickly in the next three years."

Real-time expectations are growing

In addition to personalized offers and pricing innovation, FICO’s survey also revealed that there is pressure to make the funds available quickly. The real-time transactional experiences on other platforms have led to an expectation of similar engagement from lenders.

While most Hong Kongers surveyed (62%) expected access to loaned funds in a week, 17 percent wanted access in a day and 10 percent within the hour.

"This finding continues to fit within the evolving personalization paradigm where banks need to think about the customer journey from end-to-end," added Sharma. "The FICO Platform helps banks to achieve successful digital transformation projects by eliminating silos and providing powerful point solutions such as Strategy Director, Xpress Optimization and Origination Manager."

"Lenders are cognizant that to compete effectively in today’s retail financing environment, speed to market and pricing features may be insufficient and the greatest value-add is centered on products that are bespoke and tailor-made to meet the specific needs of the customer."

FICO’s Advancing New Experiences in Digital Banking survey was conducted in December 2020 using an online, quantitative poll of 5,000 consumers across ten countries and territories carried out on behalf of FICO by an independent research company. The countries, regions, and territories surveyed were Australia, Hong Kong, Indonesia, Malaysia, New Zealand, Philippines, Singapore, Taiwan, Thailand and Vietnam.

About FICO

FICO (NYSE: FICO) powers decisions that help people and businesses around the world prosper. Founded in 1956 and based in Silicon Valley, the company is a pioneer in the use of predictive analytics and data science to improve operational decisions. FICO holds more than 195 US and foreign patents on technologies that increase profitability, customer satisfaction and growth for businesses in financial services, manufacturing, telecommunications, health care, retail and many other industries. Using FICO solutions, businesses in more than 120 countries do everything from protecting 2.6 billion payment cards from fraud, to helping people get credit, to ensuring that millions of airplanes and rental cars are in the right place at the right time.

Learn more at www.fico.com.

Join the conversation on Twitter at @FICOnews_APAC.

FICO is a registered trademark of Fair Isaac Corporation in the US and other countries

Related Links :

http://www.fico.com