ON DIGITALISATION, SUPPLIERS’ FINANCING AND ESG

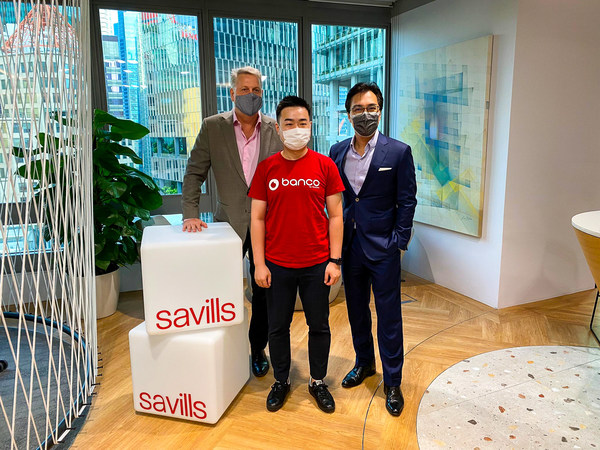

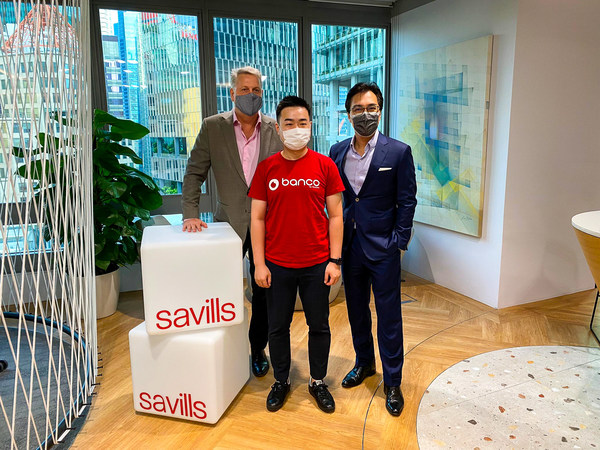

SINGAPORE, March 29, 2022 /PRNewswire/ — Leading real estate advisor, Savills (Singapore) Pte Ltd, today announced a strategic partnership with neobank banco platform, a Singapore FinTech company.

The two groups intend to digitise financing solutions in the property industry with an immediate focus on improving access and more competitive financing options to suppliers and service providers, enhancing sustainability practices through accredited green financing options.

Transforming payments through digital processes, neobank banco platform (i.e. online only financing), simplifies the issuance and payments between Strata Management stakeholders creating greater transparency, compliance, and governance for all. At the same time, banco and Savills will provide easy access to supply chain financing and early payment solutions to the many small to medium enterprises in the sector, making cash and working capital management solutions more readily available at a lower cost, to a group who have historically found access to such solutions expensive and difficult to manage.

In line with Singapore’s aspirational "Green Plan 2030" and given Deloitte’s estimate that the property sector is responsible for 40 per cent of global carbon emissions, there is a need for every aspect of the property management supply chain to work on reducing its carbon footprint. In creating a payment and financing gateway, the team will create an ecosystem around "green financing" which will ultimately power local businesses’ access to supply chain financing to assist in reducing their own carbon footprint.

Technology will continue to play a critical role in overcoming the industries many challenges, whether digitising current processes, leveraging new technologies to ease the manpower crunch or adopting a more data-driven approach to solving solutions, all will make the industry future-fit.

Marcus Loo, Chief Executive Officer, Savills Singapore, said: "This strategic partnership with a Fintech specialist like banco platform will truly enable us to elevate our service offering to clients in the MCST industry. Savills is excited to roll out some of the platforms that will help resolve our clients’ pain points by digitally connecting the payment ecosystem on to a single platform, making the entire payment process efficient, transparent, and hassle-free."

"The property management sector has a lot of potential to leverage technology. We are therefore delighted to be partnering with Savills, Singapore’s largest private MCST Managing Agent, to ease many of the problems this industry faces in transforming their payments, banking and financing processes, making them more accessible, more efficient and future-proof businesses," said Lincoln Yin, Co-founder and CEO of banco platform.

"This is an exciting collaboration bringing together Savills’ extensive property management portfolio and industry expertise with banco platform’s cutting edge FinTech capabilities, and in doing so bring meaningful solutions to the industry and playing our part to improve ESG. I truly believe this will become a widely adopted solution platform not just in Singapore, but one for the whole region," commented Chris Marriott, CEO South East Asia, Savills.

About Savills

Savills is a leading global real estate service provider listed on the London Stock Exchange. The company, established in 1855, has a rich heritage with unrivalled growth. It is a company that leads rather than follows and now has over 700 offices and associates throughout the Americas, Europe, Asia Pacific, Africa and the Middle East.

About banco platform

Founded in 2018, banco platform launched by RootAnt Group, is a Singapore-based FinTech company with investors such as SBI group, a financial services company group based in Tokyo, Japan (TYO: 8473), R3 and other strategic investors. Through its product offerings, the firm solves current challenges faced by SMEs by providing better, faster and cheaper financial and enterprise solutions on the digital financing platform.