|

Results for the Year Ending 31 December 2021

BRUSSELS, Jan. 28, 2022 /PRNewswire/ —

Highlights

Full year revenue growth stronger than expected

- Operating income up +9% year-on-year

- Business income up +15% year-on-year, with operating metrics growing strongly

– Assets under custody up +15% year-on-year to EUR 37.6 trillion

– Transactions volumes up +7% year-on-year to 295 million - Interest, banking and other income down -40% year-on-year to EUR 90 million. Year-on-year decline impacted by one off EUR 23 million capital gain in 2020 comparator. Indications that interest rate environment has bottomed in 2021 with improved outlook.

Strategy has delivered a more diversified and resilient business, better positioned to deliver value for our customers and for growth

- Multi-year investments have delivered resilient, scalable systems to meet market demand across all business lines

- Fixed income safekeeping provides subscription-like foundation to business model that is not sensitive to market conditions

- Funds, Collateral Management and Global & Emerging Market business lines proving attractive to customers

- Progress made in exploring innovative data, digital and ESG services, providing a greater breadth of products for our customers

With margin expansion above 2023 targets

- Business income margin up +4.6 percentage points year-on-year to 37.3%. This compares to financial target of low-to-mid 30% range by 2023.

- Growth in business income margin is a key strategic target as it adjusts for interest income which is sensitive to interest rate fluctuations

To deliver growing profit and shareholder returns

- Net profit up +8% to EUR 467 million excluding MFEX. Net profit at EUR 463 million including MFEX

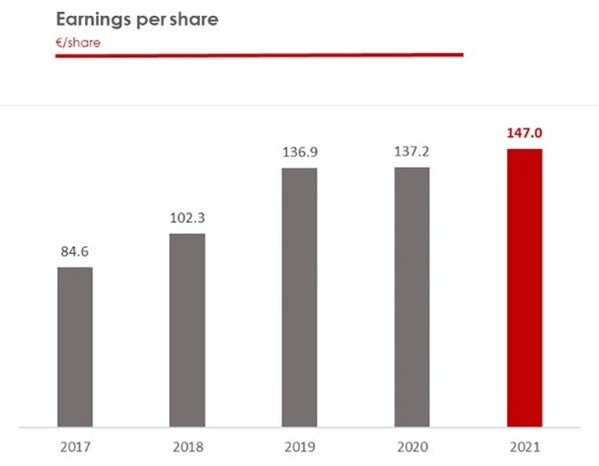

- Earnings per share (EPS) up +7% to EUR 147.0 per share

- Net Asset Value (NAV) increased +5% to EUR 1518 per share

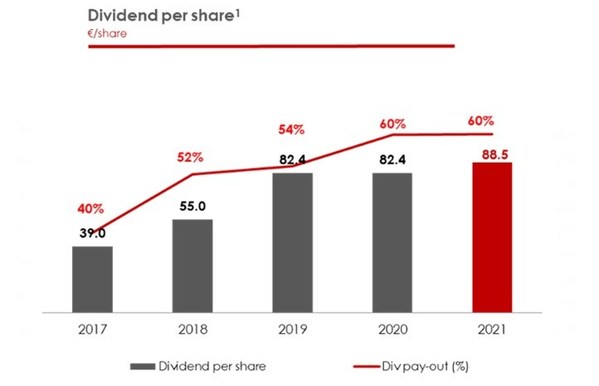

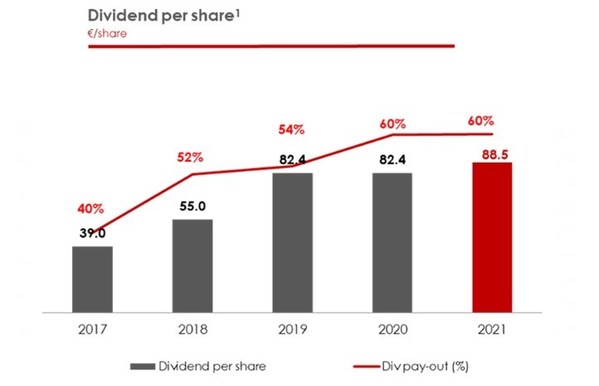

- Proposed 2021 dividend of EUR 88.5 per share, up +7.4% versus 2020. Dividend pay-out ratio stable at 60%

Strengthening our strategy: building on success to reach new ambitious targets

- Benefits of strategic direction confirmed by outperformance of 2023 targets, ahead of plan

- Management and Board finalising work to strengthen strategy and set ambitious new targets

- We expect to communicate further at a capital markets day in Q2 2022

Financial summary

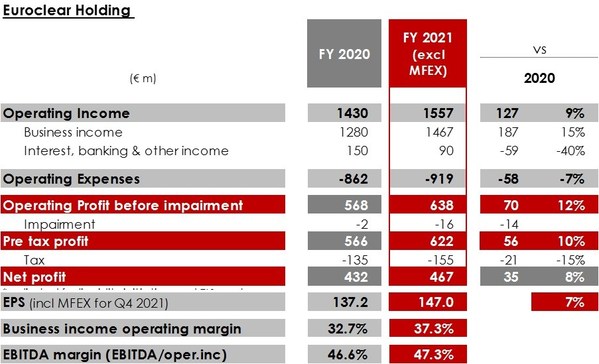

Euroclear delivered a record financial performance in 2021. Net profit was up +8% year-on-year to EUR 467 million, excluding MFEX. Including MFEX, 2021 net profit increased to EUR 463 million.

Sustained growth in business income, up +15% year-on-year to EUR 1467 million, offset the impact of lower interest rates on total operating income. Euroclear continues to invest strongly in technology systems and human capital, with operating expenses up 7% to EUR 919 million.

The group maintains a strong capital position and low risk profile, which are critical as a financial market infrastructure and create headroom for further growth.

Note: 2021 figures do not include MFEX Oct-Dec figures, except for EPS.

For additional information, please see our full year 2021 presentation available here.

Chief Executive Officer’s review

2021: Record performance and a milestone year

2021 represents a significant milestone for the group as we have now exceeded many of the key financial targets that we set out in our five-year plan to 2023, two years ahead of our expectations.

When we first set out our five-year business strategy, we set out a target to reach a business income margin in the low-to-mid 30% range. We outlined that we consider business income margin the best metric to assess the strength of our business activities.

It was an ambitious goal as the business margin was in the low-to-mid 20% range at the time. We have not only reached that objective, two years early, but our business income has surpassed the target to reach the mid-to-high 30% range. In 2021, business income margin was 37.3%, well ahead of plan.

We explained that our focus to achieve this goal was on strengthening our core business in Europe and targeting higher growth in our Funds, Collateral Management, and Global & Emerging Market business lines. We also said we would explore new areas of innovation, such as data services.

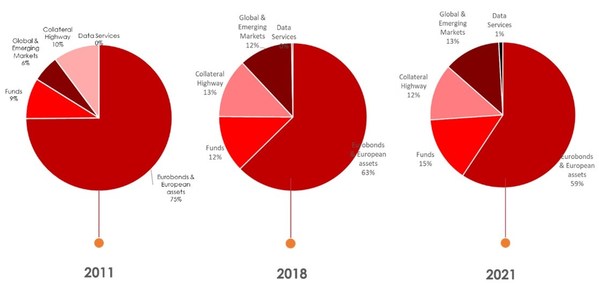

I am pleased to say that we are delivering on what we set out to achieve. Our core European business remains robust as we have consistently invested to ensure that our infrastructure is both reliable and scalable to market demand. This resilience was demonstrated through the heightened volatility during the Covid-19 pandemic which resulted in a substantial increase in transaction volumes in our core business which rose by 23% over the past two years. Meanwhile, our Funds, Collateral Management, and Global & Emerging Market businesses have grown even faster and now make up 40% of our total business income.

The scale of this transformation is even more apparent when looking over a ten-year time horizon, when our growth business lines contributed just 25% of income back in 2011. Pleasingly all four business lines contributed to that growth and all still have exciting potential for further growth. Having a stronger, more diversified business positions Euroclear well for its future strategic evolutions.

Business growth stronger than anticipated

When we outlined our strategic plans in early 2019, our assumption was that meeting customers’ needs for reliable, global financial market infrastructure would maintain the group’s business income growth trajectory at about 4% per annum.

Since then, the market context has been extraordinary. Covid-19 and the broader macro-economic conditions have brought exceptionally strong growth in issuance of securities and volatility has been very high. Our teams have demonstrated incredible commitment in such an uncertain and disruptive period to maintain business continuity and provide our customers with the highest levels of service. Meanwhile our systems have proven to be both resilient and scalable to meet this demand reliably, benefiting from investments that we have made over the past decade. In light of these conditions, our strategy allowed us to deliver business income growth of 11% CAGR since 2018.

Scalable business; Investing in our future

Euroclear’s business has proven again to be scalable in 2021 as costs increased by only 5% year-on-year (when excluding MFEX acquisition costs) despite 15% growth in business income.

Including the exceptional costs related to the acquisition, costs were up 7% to EUR 919 million.

In 2021, we also decided to use the additional headroom provided by our strong growth to accelerate investments. Our investments, totalling EUR 203 million, focused on core systems as we modernise our technology capabilities, cyber security and our customer proposition and innovation.

Interest rates are beginning to evolve positively

In 2021, interest rates appeared to reach the bottom of the cycle, having been dramatically cut in response to the pandemic.

While 2021 Interest, Banking and Other Income was only EUR 90 million in 2021, we note that some policymakers have begun to increase rates to counteract inflationary pressures.

If this latest development is maintained, we anticipate a positive impact on Interest income, which is sensitive to balances and interest rates. For context, Interest, Banking and Other Income was EUR 290 million in 2019 before the pandemic struck.

The year-on-year decline reported in Interest, Banking and Other Income in 2021 also reflect a one-off EUR 23 million capital gain reported in 2020.

Operating metrics remain robust

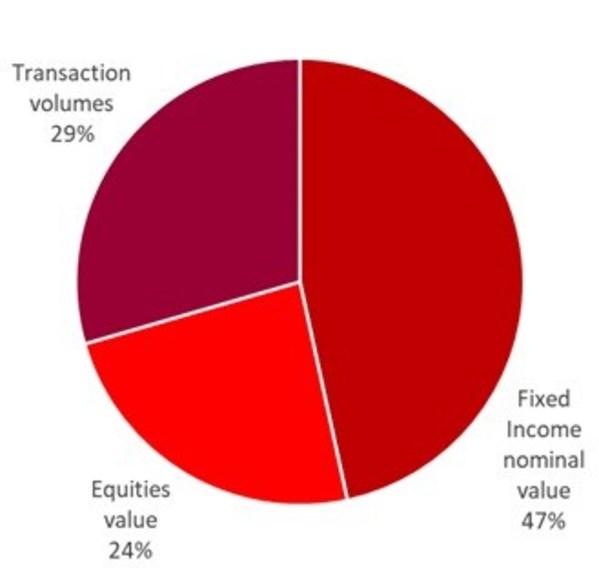

We continue to report strong operating metrics across our business lines. We have two key operating metrics to drive business income: (i) amount of assets under custody and (ii) the number of transactions processed.

The strength and scale of the group’s global network and service offering across asset classes met high demand for securities issuance and safekeeping. Assets under custody grew by 15% to reach EUR 37.6 trillion at year end. About half of the group’s business income comes from fixed income fees which, in contrast to equities, are charged on the nominal value of the securities. Since the nominal value is not impacted by market valuations, this provides a robust, subscription-like foundation for the group’s business model.

The second key driver of business income is the volume of transactions processed by the group. In 2021, we processed 295 million netted transactions, which is worth a euro equivalent of approximately EUR 992 trillion or almost EUR 1 quadrillion!

As planned, our growth business lines continue to grow more quickly than the core business. Euroclear’s Collateral Highway grew +27% to mobilise a record average daily outstanding of EUR 1.9 trillion last year, benefitting from our leading global role in providing triparty solutions as clients implement new uncleared margin rules for derivatives under Basel frameworks.

Our Global & Emerging Markets business grew assets under custody by +15% to EUR 1.5 trillion. And fund assets under custody were also up +23% to reach EUR 3.2 trillion, before inclusion of MFEX business.

Progressing major strategic initiatives

Through the course of 2021, there were a number of significant strategic achievements and I would like to pick out a few key ones here.

We have also made the most significant acquisition by the group in the past decade by purchasing MFEX for EUR 505 million. Combining MFEX’s well established fund distribution platforms with Euroclear’s post-trade expertise will create a new end-to-end funds offering for our clients. The funds market is highly attractive and we believe that the purchase of MFEX will deliver meaningful long-term value for our shareholders.

The integration of MFEX is progressing well. We expect to deliver revenue and cost synergies of at least EUR 25 million after the integration has been completed, and it is expected to be accretive to group profits from 2023.

In our core business, we were pleased to complete the successful migration of Issuer CSD services for Ireland from Euroclear UK & Ireland to Euroclear Bank. This migration, which provided long-term certainty to the €100 billion Irish securities market in light of the UK’s decision to leave the EU, was a unique, innovative and complex project involving stakeholders from the entire market.

Meanwhile, international issuers continue to seek to connect to a worldwide investor base through Euroclear. For example, in July, Chilean corporate bonds became fully Euroclearable. We also signed agreements to extend our global reach to Saudi Arabia and the United Arab Emirates, and to enhance collateral management services in Canada. We also supported the issuance of a new innovative ‘flower bond’ structure, combining domestic issuance with global distribution channels, an innovation which has gained traction amongst issuers in China and Singapore. We have focused on driving progress in data and innovation initiatives. We launched new services for issuers in our ESES and Swedish CSDs to provide insights on their shareholder base. These products aim to foster good governance practices by issuers.

We have also launched a number of digital and data services, such as SettlementDrive, to support post-trade efficiency. Moreover, we participated in the successful pilot conducted with the Banque de France to settle digital currency, with other projects underway as we explore this promising digital space.

As we look to the future, we also intensified our investment to support evolutions for the sustainable finance market as part of our group ESG strategy, which also aims to mature further our internal approach.

A study conducted with PwC showed that scaling the sustainable finance market through a financial market infrastructure approach could be impactful. The study estimated that a cross-border FMI approach could mobilise USD 25 trillion of additional capital for sustainable finance by 2030, contributing significantly to the UN’s sustainable development goals. Finally, in December, we were delighted to sign an agreement with the European Central Bank (ECB) and central banks across Europe to connect Euroclear Bank to the ECB’s TARGET2-Securities (T2S) platform. By connecting Euroclear Bank to T2S, we will be able to offer clients access to both commercial bank and central bank money through a single international CSD for the first time. Connecting Euroclear Bank to T2S further strengthens European capital markets, supporting policymakers’ ambitions for a capital markets union.

Delivering shareholder returns

We are proud to have again delivered a positive year for our shareholders, further extending our track record of generating attractive returns.

Earnings per share reached EUR 147, up +7% compared to 2020. The group has delivered an excellent compound average growth rate of 15% over the past five years.

The improved performance already allowed us to increase our dividend pay-out ratio to 60%. We have proposed a dividend that maintains this pay-out ratio, meaning that the proposed dividend per share increases by 8%, in line with earnings.

Responsibility to our people and our communities

Over the last two years the pandemic has undoubtedly increased the focus on all businesses’ responsibilities to their communities and society. Since this crisis began, Euroclear has prioritised the health and well-being of its people. This continued in 2021 as we sought to engage even more closely with our people and explored new hybrid ways of working that increase employee’s flexibility. Additionally, through the Euroclear Solidarity Fund, a €1 million donation was made in support of the hospitals and charities tackling the pandemic on the frontline.

We have also remained focused on progressing the social aspects of our broader ESG strategy. We have set out ambitious new gender equality targets within an enlarged diversity & inclusion agenda and have launched our corporate volunteering programme. Looking forward, we are focused on progressing our diversity & inclusion strategy and developing talent and skills for the future. We look forward to providing more detail in our annual report.

A final word… for now!

Given the excellent performance delivered in 2021, management and the board are now focused on strengthening our strategy and will outline new ambitious targets for the years ahead. We expect to be able to announce more details in the second quarter.

In the meantime, both market conditions and the public health situation remain dynamic and unpredictable. I would like to recognise the efforts of Euroclear’s people throughout this challenging period and to thank our partners, customers, shareholders and other stakeholders for their continued collaboration.

As we look forward, we see opportunities to extend our customer proposition to support the financial industry’s needs for safe and sustainable digital infrastructure. We are excited about what is to come and look forward to updating you on our plans for growth in the second quarter.

About Euroclear

Euroclear group is the financial industry’s trusted provider of post trade services. Euroclear provides settlement and custody of domestic and cross-border securities for bonds, equities and derivatives to investment funds. Euroclear is a proven, resilient capital market infrastructure committed to delivering risk-mitigation, automation and efficiency at scale for its global client franchise.

The Euroclear group comprises Euroclear Bank, the International CSD, as well as Euroclear Belgium, Euroclear Finland, Euroclear France, Euroclear Nederland, Euroclear Sweden and Euroclear UK & International. The Euroclear group settled the equivalent of EUR 992 trillion in securities transactions in 2021, representing 295 million domestic and cross-border transactions, and held EUR 37.6 trillion in assets for clients by end 2021. For more information about Euroclear, please visit www.euroclear.com