XIAMEN, China, March 18, 2022 /PRNewswire/ — Qudian Inc. ("Qudian" or "the Company" or "We") (NYSE: QD), a leading technology platform empowering the enhancement of the online consumer finance experience in China, today announced its unaudited financial results for the quarter and full year ended December 31, 2021.

Fourth Quarter 2021 Operational Highlights:

- Number of outstanding borrowers[1] from loan book business as of December 31, 2021 decreased by 2.7% to 2.7 million from 2.8 million as of September 30, 2021, as a result of the Company’s deployment of a conservative and prudent strategy

- Total outstanding loan balance from loan book business[2] decreased by 13.7% to RMB2.6 billion as of December 31, 2021 from RMB3.0 billion as of September 30, 2021

- Amount of transactions from loan book business for this quarter decreased by 12.0% to RMB3.0 billion from the third quarter of 2021

- Weighted average loan tenure for our loan book business was 3.9 months for this quarter, compared to 4.3 months for the third quarter of 2021

|

[1] Outstanding borrowers are borrowers who have outstanding loans from the Company’s loan book business as of a particular date. [2] Includes (i) off and on balance sheet loans directly or indirectly funded by our institutional funding partners or our own capital, net of cumulative write-offs and (ii) does not include auto loans from Dabai Auto business. |

Fourth Quarter 2021 Financial Highlights:

- Total revenues were RMB378.9 million (US$59.5 million), compared to RMB713.6 million for the same period of last year

- Net loss attributable to Qudian’s shareholders was RMB65.1 million (US$10.2 million), compared to an income of RMB673.9 million for the same period of last year, or net loss of RMB0.26 (US$0.04) per diluted ADS

- Non-GAAP net loss attributable to Qudian’s shareholders[3] was RMB59.3 million (US$9.3 million), compared to income of RMB683.5 million forthe same period of last year, or Non-GAAP net loss of RMB0.23 (US$0.04) per diluted ADS

Full Year 2021 Financial Highlights:

- Total revenues were RMB1,654.0 million (US$259.6 million) for 2021, representing a decrease of 55.2% from 2020, primarily due to the decrease in the amount of transactions

- Financing income decreased by 40.3% to RMB1,255.5 million (US$197.0 million) from RMB2,102.7 million for 2020 as a result of the decrease in the average on-balance sheet loan balance

- Transaction services fee and other related income was RMB151.7 million (US$23.8 million) for 2021, compared to a loss of RMB136.5 million for 2020

- Net income attributable to Qudian’s shareholders decreased by 38.6% year-on-year to RMB589.1 million (US$92.4 million), or RMB2.27 (US$0.36) per diluted ADS

- Non-GAAP net income attributable to Qudian’s shareholders [3] increased by 60.2% year-on-year to RMB612.4 million (US$96.1 million), or RMB2.36 (US$0.37) per diluted ADS

|

[3] For more information on this Non-GAAP financial measure, please see the table captioned "Unaudited Reconciliation of GAAP and Non-GAAP Results" set forth at the end of this press release. |

"In light of the fast-evolving market dynamics, we maintained prudent operations in our cash credit business in the fourth quarter, closing out 2021 with steady performance. We generated approximately RMB3.0 billion of transactions from our loan book business with stable asset quality during the fourth quarter," said Mr. Min Luo, Founder, Chairman and Chief Executive Officer of Qudian. "With respect to WLM KIDS, we decided to significantly downsize the business after cautiously re-evaluating the impact of recurrent pandemic outbreaks and regulations concerning the education industry. We believe this decision is in the best interest of the Company and our shareholders. We will continue to closely monitor the shifting regulatory environment and remain vigilant in our credit loan business operations as we strive to bolster the long-term sustainability of our business."

"During the fourth quarter, we remained dedicated to controlling credit risk and continued to shift toward high-quality borrowers. As a result, we have stabilized our D1 delinquency rate[4] at approximately 5% as of the end of February 2022. Looking ahead, supported by our robust balance sheet, we are well-positioned to safeguard the interests of our shareholders and stay flexible in our strategic adjustments," said Ms. Sissi Zhu, Vice President of Investor Relations of Qudian.

|

[4] "D1 delinquency rate" is defined as (i) the total amount of principal and financing service fees that became overdue as of a specified date, divided by (ii) the total amount of principal and financing services fees that was due for repayment as of such date, in each case with respect to our loan book business. |

Fourth Quarter Financial Results

Total revenues were RMB378.9 million (US$59.5 million), representing a decrease of 46.9% from RMB713.6 million for the fourth quarter of 2020.

Financing income totaled RMB296.4 million (US$46.5 million), representing a decrease of 28.0% from RMB411.8 million for the fourth quarter of 2020, as a result of the decrease in the average on-balance sheet loan balance.

Loan facilitation income and other related income decreased by 90.4% to RMB9.9 million (US$1.6 million) from RMB103.2 million for the fourth quarter of 2020, as a result of the reduction in transaction volume of off-balance sheet loans during this quarter.

Transaction services fee and other related income increased to RMB41.6 million (US$6.5 million) from RMB3.1 million for the fourth quarter of 2020, mainly as a result of the reassessment of variable consideration.

Sales income and others decreased to RMB7.2 million (US$1.1 million) from RMB161.5 million for the fourth quarter of 2020, mainly due to the decrease in sales related to the Wanlimu e-commerce platform, which we are in the process of winding down.

Sales commission fee decreased by 49.0% to RMB7.5 million (US$1.2 million) from RMB14.8 million for the fourth quarter of 2020, due to the decrease in the amount of merchandise credit transactions.

Total operating costs and expenses increased to RMB603.7 million (US$94.7 million) from RMB16.7 million for the fourth quarter of 2020.

Cost of revenues decreased by 81.0% to RMB38.3 million (US$6.0 million) from RMB201.6 million for the fourth quarter of 2020, primarily due to the decrease in cost of goods sold related to the Wanlimu e-commerce platform.

Sales and marketing expenses increased by 115.8% to RMB27.8 million (US$4.4 million) from RMB12.9 million for the fourth quarter of 2020, primarily due to the increase in staff salaries.

General and administrative expenses increased by 45.0% to RMB109.8 million (US$17.2 million) from RMB75.7 million for the fourth quarter of 2020, as a result of the increase in staff salaries primarily relating to our WLM Kids business.

Research and development expenses increased by 165.1% to RMB22.8 million (US$3.6 million) from RMB8.6 million for the fourth quarter of 2020, as a result of the increase in staff salaries.

Provision for receivables and other assets was RMB443.8 million (US$69.6 million), compared to a reversal of RMB75.6 million for the fourth quarter of 2020, as the results of the provision for our WLM Kids business, which we decided to downsize significantly.

As of December 31, 2021, the total balance of outstanding principal and financing service fee receivables for on-balance sheet transactions for which any installment payment was more than 30 calendar days past due was RMB154.1 million (US$24.2 million), and the balance of allowance for principal and financing service fee receivables at the end of the period was RMB267.0 million (US$41.9 million), indicating M1+ Delinquency Coverage Ratio of 1.7x.

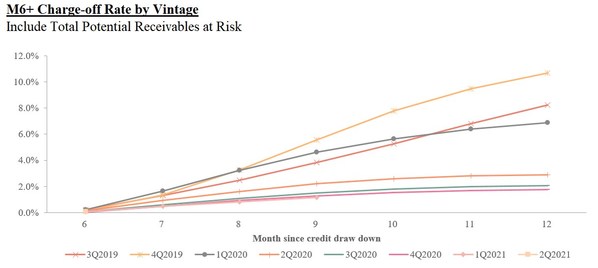

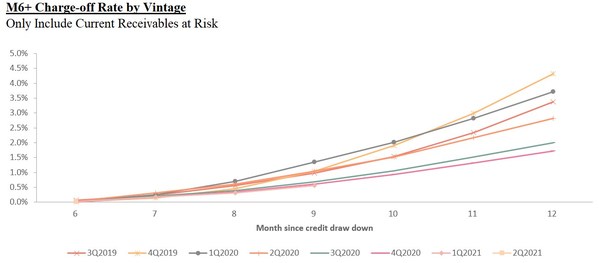

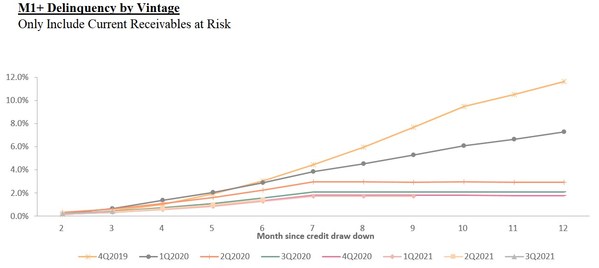

The following charts display the "vintage charge-off rate." Total potential receivables at risk vintage charge-off rate refers to, with respect to on- and off-balance sheet transactions facilitated under the loan book business during a specified time period, the total potential outstanding principal balance of the transactions that are delinquent for more than 180 days up to twelve months after origination, divided by the total initial principal of the transactions facilitated in such vintage. Delinquencies may increase or decrease after such 12-month period.

Current receivables at risk vintage charge-off rate refers to, with respect to on- and off-balance sheet transactions facilitated under the loan book business during a specified time period, the actual outstanding principal balance of the transactions that are delinquent for more than 180 days up to twelve months after origination, divided by the total initial principal of the transactions facilitated in such vintage. Delinquencies may increase or decrease after such 12-month period.

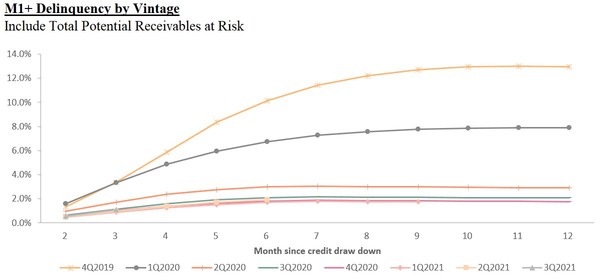

Total potential receivables at risk M1+ delinquency rate by vintage refers to, with respect to on- and off-balance sheet transactions facilitated under the loan book business during a specified time period, the total potential outstanding principal balance of the transactions that are delinquent for more than 30 days up to twelve months after origination, divided by the total initial principal of the transactions facilitated in such vintage. Delinquencies may increase or decrease after such 12-month period.

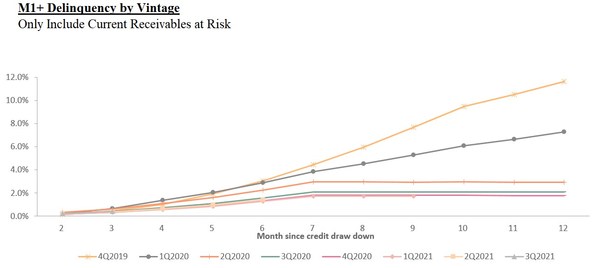

Current receivables at risk M1+ delinquency rate by vintage refers to, with respect to on- and off-balance sheet transactions facilitated under the loan book business during a specified time period, the actual outstanding principal balance of the transactions that are delinquent for more than 30 days up to twelve months after origination, divided by the total initial principal of the transactions facilitated in such vintage. Delinquencies may increase or decrease after such 12-month period.

Loss from operations was RMB168.1 million (US$26.4 million), compared to income from operations of RMB746.6 million for the fourth quarter of 2020.

Net loss attributable to Qudian’s shareholders was RMB65.1 million (US$10.2 million), or net loss of RMB0.26 (US$0.04) per diluted ADS.

Non-GAAP net loss attributable to Qudian’s shareholders was RMB59.3 million (US$9.3 million), or Non-GAAP net loss of RMB0.23 (US$0.04) per diluted ADS.

Full Year 2021 Financial Results

Total revenues were RMB1,654.0 million (US$259.6 million), a decrease of 55.2% from RMB3,688.0 million for 2020.

Financing income totaled RMB1,255.5 million (US$197.0 million), a decrease of 40.3% from RMB2,102.7 million for 2020, as a result of the decrease in the average on-balance sheet loan balance.

Loan facilitation income and other related income decreased by 95.5% to RMB43.5 million (US$6.8 million) from RMB957.8 million for 2020, as a result of the decrease in the amount of off-balance sheet transactions.

Transaction services fee and other related income was RMB151.7 million (US$23.8 million), compared to a loss of RMB136.5 million for 2020, primarily due to the change in estimate for variable consideration for the transactions facilitated in the past years.

Sales income and others substantially decreased by 83.5% to RMB100.7 million (US$15.8 million) from RMB610.8 million for 2020, mainly due to the winding down of the Wanlimu e-commerce platform.

Sales commission fee decreased by 56.3% to RMB35.4 million (US$5.6 million) from RMB81.0 million for 2020, due to the decrease in the amount of merchandise credit transactions.

Total operating costs and expenses decreased by 67.5% to RMB1,029.5 million (US$161.6 million) from RMB3,165.7 million for 2020.

Cost of revenues decreased by 65.4% to RMB298.7 million (US$46.9 million) from RMB862.4 million for 2020, primarily due to the decrease in costs related to the Dabai Auto business and the decrease in cost of goods sold related to the Wanlimu e-commerce platform.

Sales and marketing expenses decreased by 56.6% to RMB127.4 million (US$20.0 million) from RMB293.3 million for 2020. The decrease was primarily due to marketing expenses incurred by the Wanlimu e-commerce platform.

General and administrative expenses increased by 55.0% to RMB443.3 million (US$69.6 million) from RMB285.9 million for 2020, as a result of the increase in staff salaries primarily relating to our WLM Kids business.

Research and development expenses decreased by 17.2% to RMB141.3 million (US$22.2 million) from RMB170.7 million for 2020. The decrease was primarily due to the decrease in staff salaries.

Provision for receivables and other assets decreased by 86.6% to RMB220.5 million (US$34.6 million) from RMB1,641.4 million for 2020. The decrease was primarily due to the decrease in past-due on-balance sheet outstanding principal receivables compared to 2020.

Income from operations decreased by 18.3% to RMB706.8 million (US$110.9 million) from RMB865.6million for 2020.

Net income attributable to Qudian’s shareholders decreased by 38.6% to RMB589.1 million (US$92.4 million), or RMB2.27 (US$0.36) per diluted ADS.

Non-GAAP net income attributable to Qudian’s shareholders increased by 60.2% to RMB612.4 million (US$96.1 million), or RMB2.36 (US$0.37) per diluted ADS.

Cash Flow

As of December 31, 2021, the Company had cash and cash equivalents of RMB2,065.5 million (US$324.1 million) and restricted cash of RMB177.9 million (US$27.9 million). Restricted cash mainly represents security deposits held in designated bank accounts for the guarantee of on-and-off balance sheet transactions. Such restricted cash is not available to fund the general liquidity needs of the Company.

For the fourth quarter of 2021, net cash provided by operating activities was RMB61.8 million (US$9.7 million), mainly due to the adjustment of provision for receivables and other assets. Net cash provided by investing activities was RMB210.2 million (US$33.0 million), mainly due to the net proceeds of short-term investments and partially offset by the payments of deposit pledged as collateral for derivative instruments. Net cash used in financing activities was RMB6.2 million (US$1.0 million), mainly due to the repurchase of convertible senior notes and payments of interest on convertible senior notes.

For the full year of 2021, net cash provided by operating activities was RMB922.1 million (US$144.7 million), mainly attributable to net income of RMB585.9 million (US$91.9 million) and the adjustment of provision for receivables and other assets of RMB220.5 million (US$34.6 million). Net cash used in investing activities was RMB246.6 million (US$38.7 million), mainly due to the payments of deposit pledged as collateral for derivative instruments. Net cash used in financing activities was RMB84.2 million (US$13.2 million), mainly due to the repurchases of convertible senior notes.

Update on Share Repurchase and Convertible Bond Repurchase

As of the date of this release, the Company has repurchased and cancelled a total principal amount of convertible senior notes of US$297.5 million. The Company has cumulatively completed total share repurchases of approximately US$574.0 million.

About Qudian Inc.

Qudian Inc. ("Qudian") is a leading technology platform empowering the enhancement of online consumer finance experience in China. The Company’s mission is to use technology to make personalized credit accessible to hundreds of millions of young, mobile-active consumers in China who need access to small credit for their discretionary spending but are underserved by traditional financial institutions due to lack of traditional credit data or high cost of servicing. Qudian’s credit solutions enable licensed, regulated financial institutions and ecosystem partners to offer affordable and customized loans to this young generation of consumers.

For more information, please visit http://ir.qudian.com.

Use of Non-GAAP Financial Measures

We use adjusted net income/loss, a Non-GAAP financial measure, in evaluating our operating results and for financial and operational decision-making purposes. We believe that adjusted net income/loss helps identify underlying trends in our business by excluding the impact of share-based compensation expenses, which are non-cash charges, and convertible bonds buyback income. We believe that adjusted net income/loss provides useful information about our operating results, enhances the overall understanding of our past performance and future prospects and allows for greater visibility with respect to key metrics used by our management in its financial and operational decision-making.

Adjusted net income/loss is not defined under U.S. GAAP and are not presented in accordance with U.S. GAAP. This Non-GAAP financial measure has limitations as analytical tools, and when assessing our operating performance, cash flows or our liquidity, investors should not consider them in isolation, or as a substitute for net loss / income, cash flows provided by operating activities or other consolidated statements of operation and cash flow data prepared in accordance with U.S. GAAP.

We mitigate these limitations by reconciling the Non-GAAP financial measure to the most comparable U.S. GAAP performance measure, all of which should be considered when evaluating our performance.

For more information on this Non-GAAP financial measure, please see the table captioned "Unaudited Reconciliation of GAAP and Non-GAAP Results" set forth at the end of this press release.

Exchange Rate Information

This announcement contains translations of certain RMB amounts into U.S. dollars ("US$") at specified rates solely for the convenience of the reader. Unless otherwise stated, all translations from RMB to US$ were made at the rate of RMB6.3726 to US$1.00, the noon buying rate in effect on December 30, 2021 in the H.10 statistical release of the Federal Reserve Board. The Company makes no representation that the RMB or US$ amounts referred could be converted into US$ or RMB, as the case may be, at any particular rate or at all.

Statement Regarding Preliminary Unaudited Financial Information

The unaudited financial information set out in this earnings release is preliminary and subject to potential adjustments. Adjustments to the consolidated financial statements may be identified when audit work has been performed for the Company’s year-end audit, which could result in significant differences from this preliminary unaudited financial information.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the "safe harbor" provisions of the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as "will," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates" and similar statements. Among other things, the expectation of its collection efficiency and delinquency, contain forward-looking statements. Qudian may also make written or oral forward-looking statements in its periodic reports to the SEC, in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about Qudian’s beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: Qudian’s goal and strategies; Qudian’s expansion plans; Qudian’s future business development, financial condition and results of operations; Qudian’s expectations regarding demand for, and market acceptance of, its credit products; Qudian’s expectations regarding keeping and strengthening its relationships with borrowers, institutional funding partners, merchandise suppliers and other parties it collaborate with; general economic and business conditions; and assumptions underlying or related to any of the foregoing. Further information regarding these and other risks is included in Qudian’s filings with the SEC. All information provided in this press release and in the attachments is as of the date of this press release, and Qudian does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

For investor and media inquiries, please contact:

In China:

Qudian Inc.

Tel: +86-592-596-8208

E-mail: [email protected]

The Piacente Group, Inc.

Jenny Cai

Tel: +86 (10) 6508-0677

E-mail: [email protected]

In the United States:

The Piacente Group, Inc.

Brandi Piacente

Tel: +1-212-481-2050

E-mail: [email protected]

|

QUDIAN INC. |

||||||

|

Unaudited Condensed Consolidated Statements of Operations |

||||||

|

Three months ended December 31, |

||||||

|

(In thousands except for number |

2020 |

2021 |

||||

|

of shares and per-share data) |

(Unaudited) |

(Unaudited) |

(Unaudited) |

|||

|

RMB |

RMB |

US$ |

||||

|

Revenues: |

||||||

|

Financing income |

411,797 |

296,443 |

46,518 |

|||

|

Sales commission fee |

14,802 |

7,545 |

1,184 |

|||

|

Sales income and others |

161,474 |

7,158 |

1,123 |

|||

|

Penalty fee |

19,261 |

16,178 |

2,539 |

|||

|

Loan facilitation income and other related income |

103,163 |

9,925 |

1,557 |

|||

|

Transaction services fee and other related income |

3,147 |

41,638 |

6,535 |

|||

|

Total revenues |

713,644 |

378,887 |

59,456 |

|||

|

Operating cost and expenses: |

||||||

|

Cost of revenues |

(201,570) |

(38,272) |

(6,006) |

|||

|

Sales and marketing |

(12,880) |

(27,799) |

(4,362) |

|||

|

General and administrative |

(75,714) |

(109,793) |

(17,229) |

|||

|

Research and development |

(8,601) |

(22,798) |

(3,578) |

|||

|

Changes in guarantee liabilities and risk assurance liabilities(1) |

206,469 |

38,826 |

6,093 |

|||

|

Provision for receivables and other assets |

75,570 |

(443,843) |

(69,648) |

|||

|

Total operating cost and expenses |

(16,726) |

(603,679) |

(94,730) |

|||

|

Other operating income |

49,680 |

56,728 |

8,902 |

|||

|

(Loss)/Income from operations |

746,598 |

(168,064) |

(26,372) |

|||

|

Interest and investment income, net |

6,714 |

163,781 |

25,701 |

|||

|

Foreign exchange gain, net |

2,164 |

78 |

12 |

|||

|

Other income |

369 |

20 |

3 |

|||

|

Other expenses |

(5,519) |

(6,302) |

(989) |

|||

|

Net (loss)/income before income taxes |

750,326 |

(10,487) |

(1,645) |

|||

|

Income tax expenses |

(76,451) |

(55,503) |

(8,710) |

|||

|

Net (loss)/income |

673,875 |

(65,990) |

(10,355) |

|||

|

Less: net loss attributable to non- |

– |

(927) |

(145) |

|||

|

Net (loss)/income attributable to Qudian |

673,875 |

(65,063) |

(10,209) |

|||

|

(Loss)/Earnings per share for Class A and |

||||||

|

Basic |

2.66 |

(0.26) |

(0.04) |

|||

|

Diluted |

2.54 |

(0.26) |

(0.04) |

|||

|

(Loss)/Earnings per ADS (1 Class A |

||||||

|

Basic |

2.66 |

(0.26) |

(0.04) |

|||

|

Diluted |

2.54 |

(0.26) |

(0.04) |

|||

|

Weighted average number of Class A and Class B ordinary shares outstanding: |

||||||

|

Basic |

253,663,338 |

253,682,383 |

253,682,383 |

|||

|

Diluted |

267,392,578 |

265,107,010 |

265,107,010 |

|||

|

Other comprehensive loss: |

||||||

|

Foreign currency translation adjustment |

(12,921) |

(2,517) |

(395) |

|||

|

Total comprehensive (loss)/income |

660,954 |

(68,507) |

(10,750) |

|||

|

Total comprehensive (loss)/income |

660,954 |

(67,580) |

(10,604) |

|||

|

Note? |

||||||

|

QUDIAN INC. |

|||||

|

Unaudited Condensed Consolidated Statements of Operations |

|||||

|

Year ended December 31, |

|||||

|

(In thousands except for number |

2020 |

2021 |

|||

|

of shares and per-share data) |

(Audited) |

(Unaudited) |

(Unaudited) |

||

|

RMB |

RMB |

US$ |

|||

|

Revenues: |

|||||

|

Financing income |

2,102,665 |

1,255,488 |

197,013 |

||

|

Sales commission fee |

80,992 |

35,411 |

5,557 |

||

|

Sales income and others |

610,793 |

100,668 |

15,797 |

||

|

Penalty fee |

72,235 |

67,316 |

10,563 |

||

|

Loan facilitation income and other related income |

957,831 |

43,466 |

6,821 |

||

|

Transaction services fee and other related income |

(136,542) |

151,694 |

23,804 |

||

|

Total revenues |

3,687,974 |

1,654,043 |

259,555 |

||

|

Operating cost and expenses: |

|||||

|

Cost of revenues |

(862,354) |

(298,726) |

(46,877) |

||

|

Sales and marketing |

(293,282) |

(127,376) |

(19,988) |

||

|

General and administrative |

(285,905) |

(443,276) |

(69,560) |

||

|

Research and development |

(170,691) |

(141,264) |

(22,167) |

||

|

Changes in guarantee liabilities and risk assurance liabilities(1) |

87,894 |

201,602 |

31,636 |

||

|

Provision for receivables and other assets |

(1,641,362) |

(220,481) |

(34,598) |

||

|

Total operating cost and expenses |

(3,165,700) |

(1,029,521) |

(161,554) |

||

|

Other operating income |

343,324 |

82,273 |

12,911 |

||

|

Income from operations |

865,598 |

706,795 |

110,912 |

||

|

Interest and investment income, net |

338,212 |

143,886 |

22,579 |

||

|

Foreign exchange loss, net |

(107) |

(51) |

(8) |

||

|

Other income |

26,358 |

5,213 |

818 |

||

|

Other expenses |

(9,263) |

(9,434) |

(1,480) |

||

|

Net income before income taxes |

1,220,798 |

846,409 |

132,821 |

||

|

Income tax expenses |

(261,979) |

(260,482) |

(40,875) |

||

|

Net income |

958,819 |

585,927 |

91,946 |

||

|

Less: net loss attributable to non-controlling interest |

– |

(3,147) |

(494) |

||

|

Net income attributable to Qudian Inc.’s |

958,819 |

589,074 |

92,440 |

||

|

Earnings per share for Class A and Class B ordinary |

|||||

|

Basic |

3.78 |

2.32 |

0.36 |

||

|

Diluted |

3.59 |

2.27 |

0.36 |

||

|

Earnings per ADS (1 Class A ordinary share equals 1 |

|||||

|

Basic |

3.78 |

2.32 |

0.36 |

||

|

Diluted |

3.59 |

2.27 |

0.36 |

||

|

Weighted average number of Class A and Class B |

|||||

|

Basic |

253,658,448 |

253,438,807 |

253,438,807 |

||

|

Diluted |

274,333,161 |

266,292,869 |

266,292,869 |

||

|

Other comprehensive loss: |

|||||

|

Foreign currency translation adjustment |

(38,455) |

(7,577) |

(1,189) |

||

|

Total comprehensive income |

920,364 |

578,350 |

90,757 |

||

|

Total comprehensive income attributable to Qudian |

920,364 |

581,497 |

91,250 |

||

|

Note? |

|||||

|

QUDIAN INC. |

||||||

|

Unaudited Condensed Consolidated Balance Sheets |

||||||

|

As of December 31, |

As of December 31, |

|||||

|

(In thousands except for number |

2020 |

2021 |

||||

|

of shares and per-share data) |

(Audited) |

(Unaudited) |

(Unaudited) |

|||

|

RMB |

RMB |

US$ |

||||

|

ASSETS: |

||||||

|

Current assets: |

||||||

|

Cash and cash equivalents |

1,537,558 |

2,065,495 |

324,121 |

|||

|

Restricted cash |

135,404 |

177,925 |

27,920 |

|||

|

Derivative instrument |

– |

17,376 |

2,727 |

|||

|

Short-term investments |

5,042,314 |

5,926,601 |

930,013 |

|||

|

Short-term loan principal and financing service fee |

3,940,461 |

2,371,966 |

372,213 |

|||

|

Short-term finance lease receivables |

179,613 |

31,462 |

4,937 |

|||

|

Short-term contract assets |

92,813 |

27,965 |

4,388 |

|||

|

Other current assets |

762,313 |

1,599,300 |

250,965 |

|||

|

Total current assets |

11,690,476 |

12,218,090 |

1,917,285 |

|||

|

Non-current assets: |

||||||

|

Long-term finance lease receivables |

28,771 |

399 |

63 |

|||

|

Operating lease right-of-use assets |

210,898 |

300,607 |

47,172 |

|||

|

Investment in equity method investee |

349,276 |

85,582 |

13,430 |

|||

|

Long-term investments |

209,868 |

286,065 |

44,890 |

|||

|

Property and equipment, net |

302,969 |

659,101 |

103,427 |

|||

|

Intangible assets |

8,478 |

11,012 |

1,728 |

|||

|

Long-term contract assets |

23,094 |

31 |

5 |

|||

|

Deferred tax assets, net |

154,960 |

67,348 |

10,568 |

|||

|

Other non-current assets |

419,242 |

442,953 |

69,509 |

|||

|

Total non-current assets |

1,707,556 |

1,853,098 |

290,792 |

|||

|

TOTAL ASSETS |

13,398,032 |

14,071,188 |

2,208,076 |

|||

|

QUDIAN INC. |

||||||

|

Unaudited Condensed Consolidated Balance Sheets |

||||||

|

As of December 31, |

As of December 31, |

|||||

|

(In thousands except for number |

2020 |

2021 |

||||

|

of shares and per-share data) |

(Audited) |

(Unaudited) |

(Unaudited) |

|||

|

RMB |

RMB |

US$ |

||||

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

||||||

|

Current liabilities: |

||||||

|

Short-term lease liabilities |

23,763 |

34,522 |

5,417 |

|||

|

Accrued expenses and other current liabilities |

336,790 |

379,816 |

59,601 |

|||

|

Guarantee liabilities and risk assurance liabilities(2) |

31,400 |

886 |

139 |

|||

|

Income tax payable |

80,656 |

78,294 |

12,286 |

|||

|

Total current liabilities |

472,609 |

493,518 |

77,444 |

|||

|

Non-current liabilities: |

||||||

|

Deferred tax liabilities, net |

10,923 |

48,606 |

7,627 |

|||

|

Convertible senior notes |

822,005 |

681,401 |

106,927 |

|||

|

Long-term lease liabilities |

80,236 |

168,800 |

26,488 |

|||

|

Long-term borrowings and interest payables |

102,415 |

145,312 |

22,803 |

|||

|

Other non-current liabilities |

– |

10,012 |

1,571 |

|||

|

Total non-current liabilities |

1,015,579 |

1,054,131 |

165,416 |

|||

|

Total liabilities |

1,488,188 |

1,547,649 |

242,860 |

|||

|

Shareholders’ equity: |

||||||

|

Class A Ordinary shares |

132 |

132 |

21 |

|||

|

Class B Ordinary shares |

44 |

44 |

7 |

|||

|

Treasury shares |

(371,551) |

(346,321) |

(54,345) |

|||

|

Additional paid-in capital |

4,007,260 |

4,017,375 |

630,414 |

|||

|

Accumulated other comprehensive loss |

(51,420) |

(58,997) |

(9,258) |

|||

|

Non-controlling interests |

10,000 |

6,853 |

1,075 |

|||

|

Retained earnings |

8,315,379 |

8,904,453 |

1,397,303 |

|||

|

Total shareholders’ equity |

11,909,844 |

12,523,539 |

1,965,217 |

|||

|

TOTAL LIABILITIES AND SHAREHOLDERS’ |

13,398,032 |

14,071,188 |

2,208,076 |

|||

|

Note: |

||||||

|

QUDIAN INC. |

|||||||

|

Unaudited Reconciliation of GAAP And Non-GAAP Results |

|||||||

|

Three months ended December 31, |

|||||||

|

2020 |

2021 |

||||||

|

(In thousands except for number |

(Unaudited) |

(Unaudited) |

(Unaudited) |

||||

|

of shares and per-share data) |

RMB |

RMB |

US$ |

||||

|

Total net (loss)/income attributable to Qudian Inc.’s shareholders |

673,875 |

(65,063) |

(10,209) |

||||

|

Add: Share-based compensation expenses |

5,050 |

5,747 |

902 |

||||

|

Less: Convertible bonds buyback loss |

(4,586) |

(36) |

(6) |

||||

|

Non-GAAP net (loss)/income attributable to Qudian Inc.’s shareholders |

683,511 |

(59,280) |

(9,301) |

||||

|

Non-GAAP net (loss)/income per share—basic |

2.69 |

(0.23) |

(0.04) |

||||

|

Non-GAAP net (loss)/income per share—diluted |

2.57 |

(0.23) |

(0.04) |

||||

|

Weighted average shares outstanding—basic |

253,663,388 |

253,682,383 |

253,682,383 |

||||

|

Weighted average shares outstanding—diluted |

267,392,578 |

265,107,010 |

265,107,010 |

||||

|

QUDIAN INC. |

|||||||

|

Unaudited Reconciliation of GAAP And Non-GAAP Results |

|||||||

|

Year ended December 31, |

|||||||

|

2020 |

2021 |

||||||

|

(In thousands except for number |

(Audited) |

(Unaudited) |

(Unaudited) |

||||

|

of shares and per-share data) |

RMB |

RMB |

US$ |

||||

|

Total net income attributable to Qudian Inc.’s shareholders |

958,819 |

589,074 |

92,440 |

||||

|

Add: Share-based compensation expenses |

45,634 |

35,349 |

5,547 |

||||

|

Less: Convertible bonds buyback income |

622,109 |

12,046 |

1,890 |

||||

|

Non-GAAP net income attributable to Qudian Inc.’s shareholders |

382,344 |

612,377 |

96,095 |

||||

|

Non-GAAP net income per share—basic |

1.51 |

2.42 |

0.38 |

||||

|

Non-GAAP net income per share—diluted |

1.49 |

2.36 |

0.37 |

||||

|

Weighted average shares outstanding—basic |

253,658,448 |

253,438,807 |

253,438,807 |

||||

|

Weighted average shares outstanding—diluted |

274,333,161 |

266,292,869 |

266,292,869 |

||||