SHANGHAI, Aug. 30, 2022 /PRNewswire/ — Recently, Yole Intelligence, part of Yole Group, a world-renowned marketing and strategic consulting firm, released the "LiDAR 2022 – Focus on Automotive and Industrial" report. The report reveals the market share of leading LiDAR manufacturers in automotive and industrial applications.

According to this report, with a strong emergence of the intelligent driving industry in China, Chinese manufacturers such as Hesai have become important players in the global LiDAR market.

"Among the LiDAR manufacturers, Hesai ranks first in ADAS design wins, L4 autonomous driving LiDAR market share, and total revenue for automotive LiDAR", announces Pierrick Boulay, Senior Technology & Market Analyst at Yole Intelligence, in this report.

Hesai Ranks 1st on ADAS Design Wins Globally

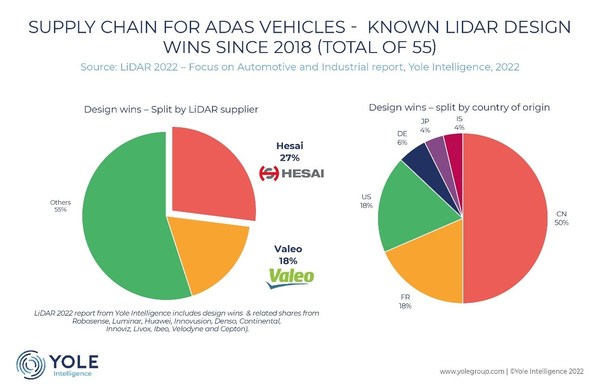

The report points out that LiDAR application is seeing a significant increase in mass-produced passenger vehicles. For now, Chinese LiDAR suppliers have represented 50% of the global ADAS market. With a close partnership established between LiDAR manufacturers and automakers, Chinese smart electric vehicle market is rapidly developing.

With 27% of the existing design wins, Hesai now ranks first in the global ADAS market. Designed for ADAS applications in mass production passenger and commercial vehicles, Hesai’s AT128 is an automotive grade, long-range hybrid solid-state LiDAR. The sensor has already won multiple contracts from world’s leading automakers, officially disclosed partners including Li Auto, JiDU, HiPhi, and Lotus. AT128 will be installed on various car models, and it has already entered the mass production and delivery stage this year.

The market research & strategy consulting company estimates that in 2022, more than 200,000 LiDARs will be manufactured and delivered, among which 20% of the LiDARs are from Hesai, just after Valeo.

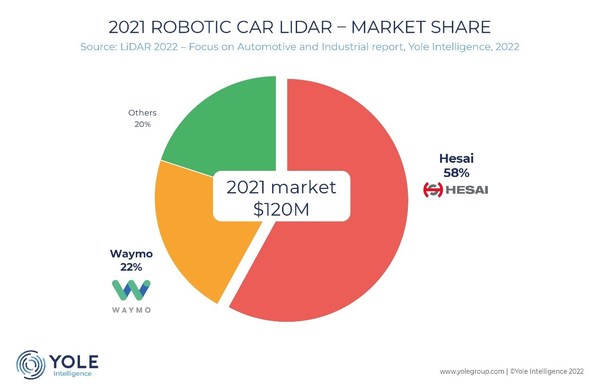

Hesai Ranks 1st in L4 Autonomous Driving LiDAR Market Share

The report states that comparing to 2020, L4 autonomous driving LiDAR market had an 11% increase in 2021, reaching $120 million. Autonomous driving companies from China and the United States had a head start in LiDAR deployment. Among them, Hesai leads with 58% of the L4 autonomous driving LiDAR market revenue, ranking 1st place globally.

According to Yole Intelligence, almost all leading L4 autonomous driving companies have chosen Hesai’s LiDAR products, including Cruise, Zoox, Nuro, TuSimple, as well as Chinese companies such as Baidu Apollo, Meituan (autonomous delivery vehicle), WeRide, AutoX and Pony AI. In California DMV’s 2021 Self-Driving Car Disengagements Report[1], 12 out of 15 leading autonomous driving companies choose Hesai as their primary LiDAR solution provider.

Hesai’s Total Revenue Ranks 1st for Automotive LiDAR Globally

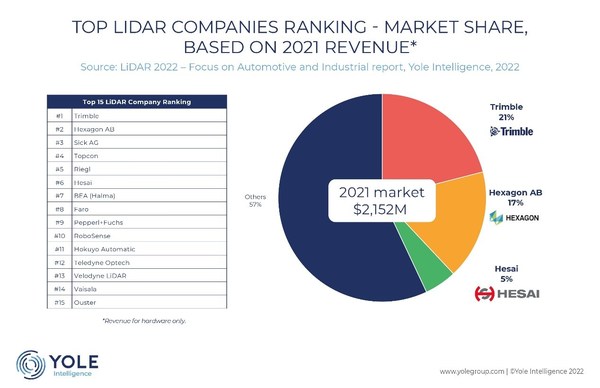

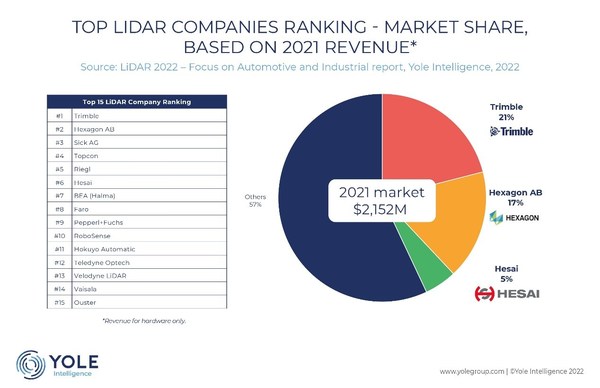

"The total market size of LiDAR for automotive and industrial applications in 2021 reached $2.1 billion in 2021, an 18% increase compared to last year’s total market size", explains Alexis Debray, Senior Technology & Market Analyst at Yole Intelligence. And he adds: "Overall, the leading LiDAR providers have seen significant revenue growth in 2021."

Notably, the top five companies are LiDAR suppliers from industrial and mapping fields. While in the field of automotive LiDAR, Hesai’s revenue ranks 1st place among global LiDAR companies.

Proprietary ASICs and in-house manufacturing have always been Hesai’s critical development strategies. ASIC technology greatly simplifies the traditional complex LiDAR assembly process. It pushes LiDAR onto the track of Moore’s Law, continuously increasing performance, while lowering production costs. On the other hand, in-house manufacturing ensures rapid iteration and strong delivery capabilities, providing abundant support for the production and delivery of large-scale ADAS LiDAR applications.

In addition, Yole Intelligence points out the scale of LiDAR applications will continue to expand, with room for improvement in terms of LiDAR performance and cost. As new technologies such as VCSEL, SiPM, SPAD and LiDAR ASICs continue to develop, they will empower LiDAR production to enter the era of mass production.

After four successful events, Yole Group is proud to collaborate once again with the China International Optoelectronic Expo (CIOE) to organize the Fourth Executive Forum on LiDAR for Automotive. On September 7, 2022, in Shenzhen, Yole Group invites Min Cui from Hesai to deliver his vision of the LiDAR market and status of technologies. Discover the program & Register today.

About Yole Group

Yole Group is an international company recognized for its expertise in the analysis of markets, technological developments, and supply chains, as well as the strategy of key players in the semiconductor, photonics, and electronics sectors.

With Yole Intelligence, Yole SystemPlus and Piséo, the group publishes market, technology, reverse engineering and costing analyses and provides consulting services in strategic marketing and technology analysis. The Yole Group Finance division also offers due diligence assistance and supports companies with mergers and acquisitions.

Yole Group benefits from an international sales network. The company now employs more than 180+ people. More information on www.yolegroup.com .

About Hesai

Founded in 2014, Hesai Technology is a global leader in LiDAR technology for autonomous driving and ADAS. Its vision is to empower robotics and elevate lives through high-performance, reliable, and low-cost 3D sensors. Hesai has developed exceptional R&D capabilities, accumulating deep expertise in optics, mechanics, electronics, and software. The company has been granted hundreds of patents globally for its industry-leading technologies, in areas such as proprietary LiDAR chips, functional safety, and interference rejection. Hesai’s new manufacturing center for automotive production will complete construction in 2022, with a planned capacity of over 1 million units. Hesai has won customers spanning over 90 cities in 40 countries, including leading autonomous driving developers, OEMs, Tier 1 suppliers, and robotics companies.

[1] 2021 Self-Driving Car Disengagements Report, released by California Department of Motor Vehicles (DMV) https://www.dmv.ca.gov/portal/vehicle-industry-services/autonomous-vehicles/disengagement-reports/; Primary lidar solution provider: lidar supplier with the largest share by purchase dollar amount for the current fleet of each of the 12 companies.